Organizations must increasingly recognizing the significance of Environmental, Social, and Governance (ESG) factors in driving sustainable growth. By implementing robust ESG initiatives, businesses can strengthen their brand image within the market, engage both investors and talent, and reduce their environmental footprint.

A strategic approach to ESG encompasses {key areas such as emissions reduction, community engagement, and transparency. Furthermore, integrating ESG considerations into operational processes can lead to tangible benefits, including cost savings, improved efficiency, and increased innovation.

By embracing sustainable practices and promoting ethical behavior, organizations can create a more responsible future for themselves and the world.

Embedding Social Responsibility into Business Strategy

In today's dynamic marketplace, organizations are increasingly recognizing the importance of integrating social responsibility into their core business models. ESG (Environmental, Social, and Governance) principles are becoming mainstream, driving businesses to adopt initiatives that benefit not just shareholders but also stakeholders, communities, and the planet.

This shift reflects a growing understanding that long-term profitability is inextricably linked to sustainable business practices.

- Corporations are actively seeking ways to reduce their environmental footprint.

- Moreover, they are emphasizing diversity, equity, and inclusion within their organizations.

- As a result, ESG integration is no longer simply a trend but rather a necessity for organizations that strive for long-term growth.

Unlocking Value: The Business Case for ESG investments

In today's dynamic business environment, companies are increasingly recognizing the significant benefits of embracing Environmental, Social, and Governance (ESG) principles. ESG investments go beyond traditional financial metrics, considering a company's impact on the ecosystem, its workforce, and its leadership. This holistic approach not only reduces risk but also enhances profitability.

- Stakeholders are demanding greater accountability from businesses, shifting their preferences towards companies that demonstrate a commitment to ESG principles.

- Research findings increasingly reveal a positive correlation between strong ESG performance and long-term value creation.

- Organizations that embrace ESG are often better positioned to attract top talent, enhance their customer loyalty, and navigate evolving legal frameworks.

By integrating ESG considerations into business models, companies can drive sustainable development. This paradigm shift is not merely a trend but a fundamental necessity for businesses that aspire to make a meaningful difference.

ESG Reporting: Transparency and Accountability in a Changing World

In today's dynamic global landscape, Environmental, Social, and Governance (ESG) reporting is emerging. Corporations are presented with mounting pressure from investors, regulators to reveal their ESG credentials. This shift is driven by a growing awareness that sustainable business practices are not only responsibly sound but also vital for long-term profitability.

- Robust ESG reporting provides visibility into a company's commitment toward environmental protection, social responsibility, and good governance.

- Stakeholders can use this insights to make informed investment decisions and support companies that align with their values.

- Furthermore, strong ESG reporting can enhance a company's reputation and incentivize top talent.

Ultimately, the goal of ESG reporting is to promote a more responsible business environment that benefits both companies and society as a whole.

Measuring Impact: ESG Performance Metrics and Benchmarks

Evaluating the efficacy of Environmental, Social, and Governance (ESG) initiatives requires robust metrics and benchmarks. A wide range of indicators measure a company's performance across key ESG domains.

These metrics capture a firm's responsibility to sustainability, employee well-being, and ethical governance. Investors utilize these metrics to evaluate the resilience of companies and guide investment decisions aligned with ESG principles.

Benchmarking against industry peers or best-in-class performers allows companies to identify areas for enhancement. This system fosters continuous evolution and promotes transparency in ESG reporting.

The Future of Finance: ESG as a Catalyst for Positive Change

The financial landscape is evolving at an unprecedented pace, fueled by growing investor consciousness for sustainable and responsible practices. ESG (Environmental, Social, and Governance) investing is gaining traction as the key driver behind this transformation. Investors are increasingly recognizing companies that demonstrate strong ESG credentials, leading to a shift towards a more sustainable and inclusive financial system.

These developments has the potential to generate significant positive impact across various sectors, from sustainable agriculture to social justice. By {aligning financial capital allocation with sustainability objectives, we can create a future where check here finance serves as a powerful tool for building a more equitable and sustainable world.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Susan Dey Then & Now!

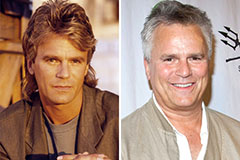

Susan Dey Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!